Choosing the right health insurance plan is one of the most important financial decisions you will ever make. With rising healthcare costs in Tier-1 countries like the United States, United Kingdom, Canada, and Australia, having the right coverage can protect you from unexpected medical bills that can easily run into thousands of dollars.

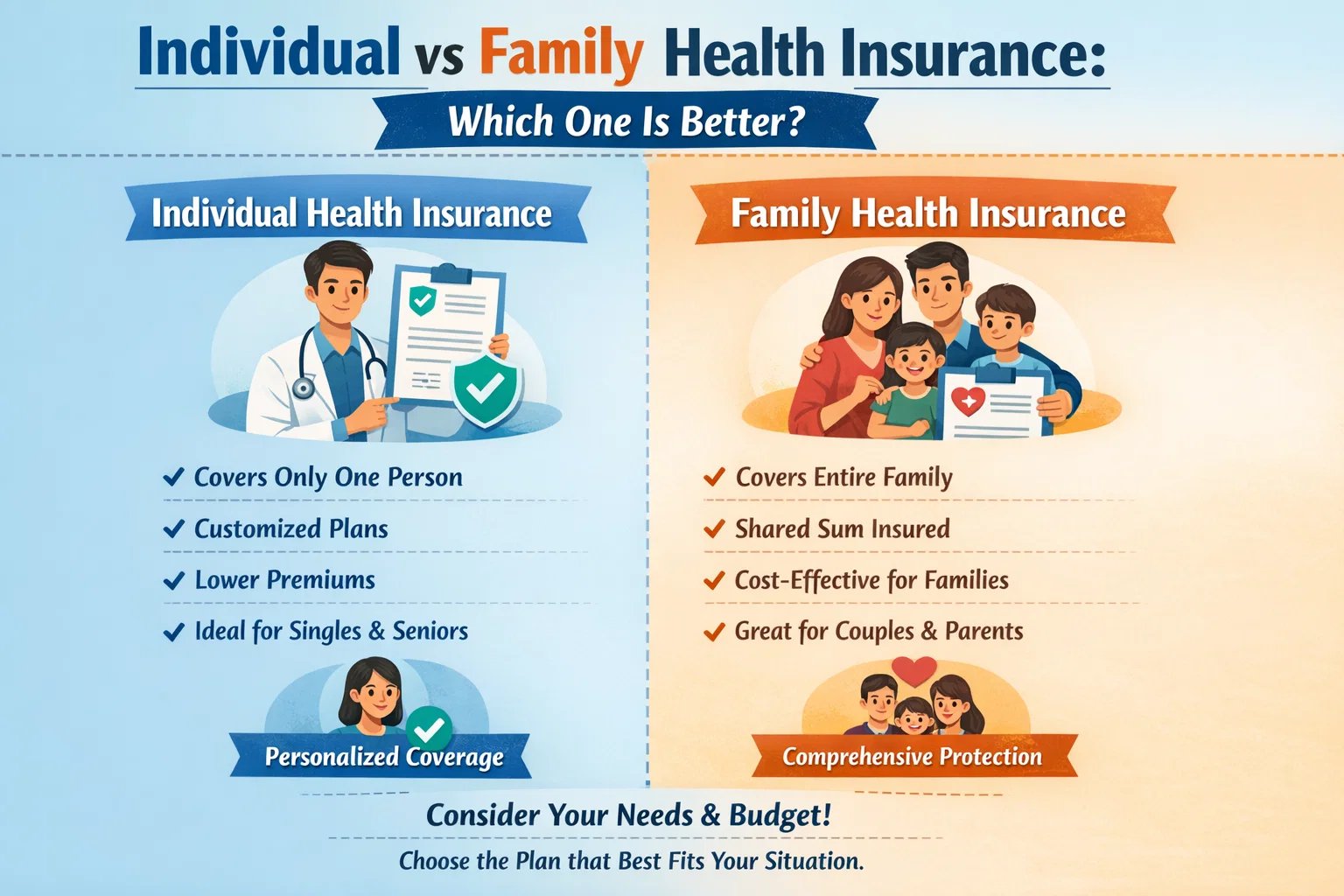

One of the most common questions people ask is whether to choose individual health insurance or family health insurance. Both options have unique advantages, limitations, and ideal use cases. This guide explains everything you need to know to make a smart, cost-effective decision.

What Is Individual Health Insurance?

Individual health insurance is a policy designed to cover a single person. The premium, deductible, benefits, and coverage limits apply only to the insured individual.

Key Features of Individual Health Insurance

- Coverage for one person only

- Premium based on age, health, and lifestyle

- Separate sum insured for each policyholder

- Ideal for singles, freelancers, and young professionals

In countries like the United States, individual plans are commonly purchased through private insurers or health insurance marketplaces and often allow flexible customization.

What Is Family Health Insurance?

Family health insurance—often called a family floater plan—covers multiple family members under a single policy. This usually includes the policyholder, spouse, children, and sometimes dependent parents.

Key Features of Family Health Insurance

- Single policy for the entire family

- Shared sum insured across members

- Lower total premium compared to separate plans

- Simplified management and renewals

Family plans are especially popular in Tier-1 countries where hospitalization costs can exceed $10,000 for a single visit.

Individual vs Family Health Insurance: Side-by-Side Comparison

| Feature | Individual Health Insurance | Family Health Insurance |

|---|---|---|

| Coverage | One person | Multiple family members |

| Premium Cost | Lower for one individual | Higher than single plan but cheaper than multiple policies |

| Sum Insured | Dedicated to one person | Shared across family |

| Flexibility | Highly customizable | Limited per member |

| Policy Management | Multiple policies required | Single consolidated policy |

| Best For | Singles, freelancers, seniors | Couples and families with children |

Cost Comparison: Which Is More Affordable?

Individual Plan Costs

Individual premiums are usually lower for young and healthy people.

- USA: $250 – $600 per month

- UK: £40 – £120 per month

- Canada: CAD 80 – 200 per month

Family Plan Costs

Family plans often cost 30–50% less than buying separate policies for each member. For example, instead of $1,200/month for four individuals, a family plan may cost $700–$900/month.

Coverage Benefits: Individual vs Family

Hospitalization & Emergency Care

Both plans cover hospital stays, ICU care, ambulance services, and emergencies. However, family plans share total coverage, which may be risky if multiple members need care in the same year.

Preventive Care

Most modern plans include annual checkups, screenings, and vaccinations.

Maternity & Child Benefits

Family plans often include maternity care, newborn coverage, and pediatric services—making them ideal for growing families.

Tax Benefits & Financial Advantages

- USA: Premiums may be tax-deductible for self-employed individuals

- Canada: Eligible for medical expense tax credits

- UK: Employer-provided insurance may be tax-efficient

Family plans often provide better overall tax efficiency due to a single consolidated premium.

Who Should Choose Individual Health Insurance?

- Single professionals

- Freelancers or digital nomads

- Senior citizens needing higher coverage

- People with specific medical conditions

Who Should Choose Family Health Insurance?

- Married couples

- Families with children

- Households seeking premium savings

- People wanting simplified policy management

Common Mistakes to Avoid

- Choosing low coverage just to reduce premiums

- Ignoring deductibles and co-payment terms

- Not planning for future medical needs

- Overlooking hospital network coverage

Expert Recommendation: Which One Is Better?

There is no universal answer.

- If you are single and want flexibility → choose individual insurance.

- If you have dependents and want cost savings → choose family insurance.

Many households use a hybrid strategy—family coverage for spouse and children, plus individual plans for elderly parents.

Final Thoughts

Health insurance is not just an expense—it is an investment in financial security and peace of mind. Whether you choose individual or family coverage, ensure the policy fits both your current lifestyle and future healthcare needs.

Always compare plans, read policy documents carefully, and consult a licensed advisor when necessary. The right decision today can save you thousands in the future.