Choosing the right insurance policy is one of the most important financial decisions you will ever make. Whether it’s life insurance, health insurance, car insurance, or travel insurance, the wrong choice can lead to uncovered claims, higher premiums, and financial stress during emergencies—especially in high-cost Tier-1 countries such as the USA, UK, Canada, and Australia.

This professional guide explains how to compare insurance policies effectively so you can secure the best protection at the right price.

Why Comparing Insurance Policies Is So Important

Buying insurance based only on brand name, agent advice, or low premium often results in underinsurance or unnecessary expenses. Proper comparison helps you:

- Get maximum coverage for your budget

- Avoid hidden exclusions and rejected claims

- Choose insurers with higher claim approval rates

- Ensure long-term financial protection

Step 1: Clearly Define Your Insurance Needs

Before comparing policies, understand your real risk exposure.

- What type of insurance do you need?

- How much coverage is enough?

- Who depends on your income?

- Which risks would cause the biggest financial loss?

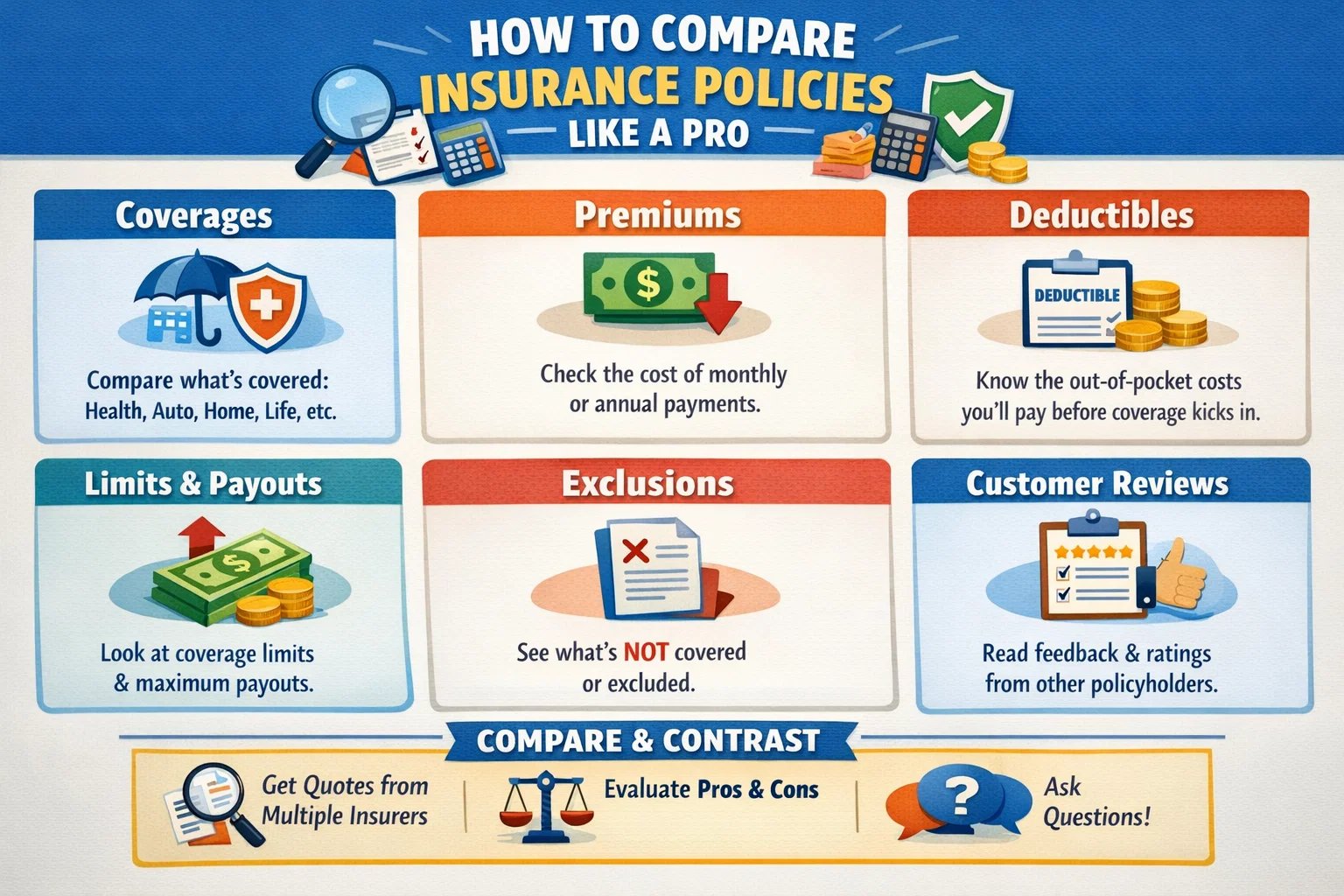

Step 2: Compare Coverage — Not Just Premium

| Comparison Factor | Low-Premium Policy | Comprehensive Policy |

|---|---|---|

| Coverage Amount | Limited | High & Adequate |

| Exclusions | Many | Minimal |

| Claim Approval | Lower | Higher |

| Long-Term Value | Poor | Excellent |

Always prioritize strong coverage over small premium savings.

Step 3: Review Policy Inclusions Carefully

- Hospitalization or medical limits

- Emergency evacuation benefits

- Accidental death or disability coverage

- Cashless treatment network

- Worldwide or Tier-1 country protection

Step 4: Understand Policy Exclusions

Exclusions define when claims are denied. Common exclusions include:

- Pre-existing medical conditions

- Self-inflicted injuries

- Alcohol or drug-related incidents

- High-risk activities

- War or civil unrest

Step 5: Compare Deductibles and Co-Payments

Higher deductibles reduce premiums but increase out-of-pocket costs during claims. Smart comparison balances affordability with realistic emergency expenses.

Step 6: Check Claim Settlement Ratio & Reputation

- Look for consistently high claim settlement ratios

- Read real customer reviews and complaints

- Prefer financially strong, globally recognized insurers

Step 7: Evaluate Riders and Add-Ons

High-value riders significantly improve protection:

- Critical illness coverage

- Accidental death benefit

- Waiver of premium

- Zero depreciation (car insurance)

- Pre-existing disease cover

Step 8: Read Policy Terms and Conditions

- Waiting periods

- Renewal rules

- Grace period duration

- Portability options

Step 9: Compare Long-Term Costs

Don’t evaluate only the first-year premium. Review projected premium increases over 5–20 years, especially for life and health insurance.

Step 10: Use Online Comparison Tools Carefully

Comparison websites are helpful but may promote sponsored plans. Use them for research—not final decisions.

Common Mistakes to Avoid

- Choosing the cheapest policy blindly

- Ignoring exclusions and deductibles

- Skipping claim history checks

- Not planning for future needs

- Relying only on agent advice

Pro Tips to Compare Like an Expert

- Compare at least 3–5 policies

- Match coverage to real risks

- Prioritize transparency over branding

- Choose flexible, upgradeable plans

- Review coverage every year

Final Thoughts

Learning how to compare insurance policies like a professional helps you make smarter financial decisions and avoid costly mistakes. The best insurance policy isn’t the cheapest—it’s the one that reliably protects you when you need it most.